In Oct. 2024, Saint Louis county launched the Senior Property Tax Freeze Program. This program is authorized by RSMo Section 137.1050 and adopted by the county government; homeowners aged 62 or up may apply and eligible applicants will be exempted from property tax increase in the future.

According to Councilman Hancock, representing district 3 at the County Council, the county received over 60,000 applicants for the program, which is around 12% of homeowners.

“It’s very, very popular with taxpayers,” Hancock said. “And I haven’t heard from a single taxpayer who said we shouldn’t have done this, they all see it as a huge benefit to them.”

Hancock, who voted for this program as a council member, believed most people retire and live on a fixed income at 62 years old. This tax freeze program will help relieve these seniors financially.

“It enables them to stay in their homes, to budget more easily and take inflation out of the equation for their property taxes,” Hancock said.

Hancock believed this program also helped the poorer communities.

“If they get hit with a 10% property tax increase, that could be enough to really put them over the edge,” Hancock said. “We see this as a way to keep not only folks in the more affluent suburbs in their homes, but also folks who’ve lived in their homes for 30 or 40 years to stay there as well.”

The county council also considered 330 taxing entities in St Louis County when establishing the program. Hancock reported that these entities will not lose revenue in the future.

“Assume the state normal rate of inflation, say, 3%, the amount of revenue they [taxing entities] received would actually increase over time,” Hancock said. “because the number of households that are eligible for the tax freeze are relatively small.”

The Chief Financial Officer of Parkway School District Carrie Nunn, however, reported that according to a 10-year projection provided by the county director of revenue, the district will lose over 31.4 million of funding over the next ten years.

“The county isn’t able to give us figures or numbers yet for how we’re going to be financially impacted. So we went to a demographic study, and about 48% of our area would be eligible for the tax freeze,” Nunn said. “I’m going to assume that 48% of that growth [in property tax] we will not receive.”

When brought up the loss in revenue to Hancock, he expressed doubt in the number.

“I would question where that number is coming from. It doesn’t match up with anything that we saw,” Hancock said. “It may be a case of coming up with a model that doesn’t reflect reality.”

Nunn said that for Parkway School District, 90% of funding comes from local real estate and property tax, therefore this program has a direct impact on district budget.

“He [director of revenue] shared with every single school district what they were projected to lose,” Nunn said. “And Parkway was ranked the highest in loss over a 10 year period.”

For school districts, Nunn said that expenses are often growing faster than revenue. A Tax freeze put further strain on the budget.

“Revenue has a tendency to grow anywhere from 2% to 3% a year, whereas your expenses have the potential to grow 3% to 5% a year,” Nunn said. “When you already have a situation where your expenses are growing faster than your revenue, and then your local entity adds in another factor that decreases your revenue, it causes it [school budget] to go even more out of whack.”

Nunn said the district is adjusting the budget to accommodate for the loss in revenue. Currently, the district is not planning on cutting salaries for staff, since highly qualified teachers ensure students’ success, which is one of the district’s goals.

“That [not cutting pay] aligns with our strategic plan,” Nunn said. “When 75 to 80% of our expenses are salary and benefits, I think that’s a clear message that we 100% value our educators over supplies and services.”

For the upcoming fiscal year, every school will get a 10% cut for their per-pupil allocation, meaning the amount of money they spent on each student. Building principals will decide what supplies will be cut for their school.

“Based on that, they talk to different department heads and they look at their goals for their building, and they decide how to spend this money for the school building and students,” Nunn said.

The building principal at Parkway Central High School, Dr. Tim McCarthy, explained that these conversations are already happening, and budget adjustments look different for all departments.

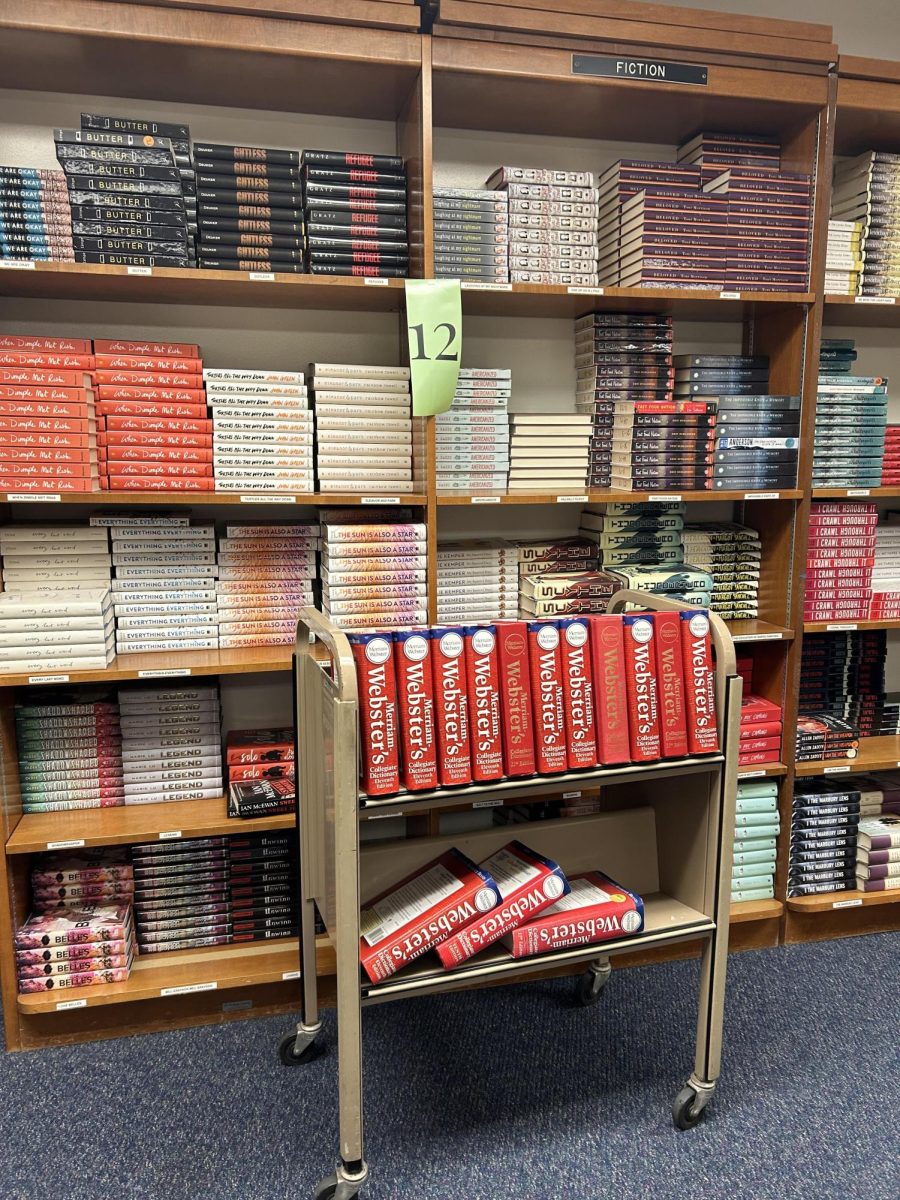

“Some departments, like English, have larger budgets because they have more students and more teachers,” McCarthy said. “The departments that really have a lot of consumables, like FACS and art, are just a little bit of a puzzle. But generally speaking, most departments went down some to absorb the reduction.”

FACS teacher Hilary Grabow explained inflation has impacted the department in the past few years, causing teachers to adjust its curriculum.

“With the cost of eggs, looking at just a couple of years ago, they were $1.29 a dozen and they’re currently close to $6 a dozen,” Grabow said. “We’ve changed recipes, tried different avenues, [and] we are doing what we can to keep the program thriving.”

Because of the constrained budget, the FACS department adjusts the things it purchases for its classes.

“As far as adjusting ingredients, maybe not offer as many options, [cutting] more expensive products such as swapping margarine for butter when possible.” Grawbow said.

McCarthy appreciated the district leaders’ approach to the financial change, and said the teachers are also cooperative in fixing the budget.

“It’s better to do a little bit now than to ignore it and then be potentially faced with a crisis situation down the road,” McCarthy said. “And I think as I talked with department leaders in this process, they understood that.”

Nunn believed that budget reduction is challenging, but it’s important to let people know the district values staff salaries and try to keep everything financially stable.

“It’s just about being transparent with your community,” Nunn said. “So then they can feel like they are part of the team and understand why they’re making those hard decisions.”